Further Down The Spiral

"And following our will and wind we may just go where no one's been

We'll ride the spiral to the end and may just go where no one's been" -Tool | Lateralus

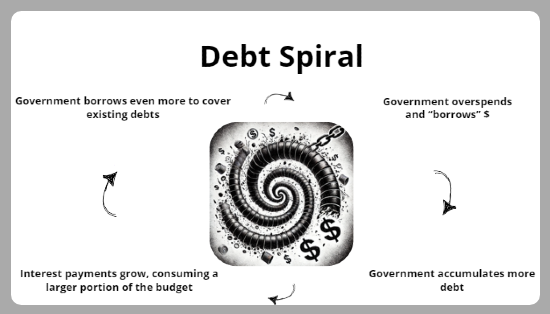

The Debt Spiral.

When an entity (government, corporation, or individual) can no longer manage its debt and is forced to continuously borrow more to cover existing obligations, leading to an unsustainable cycle of increasing debt.

Since divorcing Gold in 1971, the U.S. has been running deficits and borrowing to pay the bills.

How long can this go on? Will we eventually run out of road to keep kicking the can?

We're just borrowing from ourselves, right? What's the big deal.

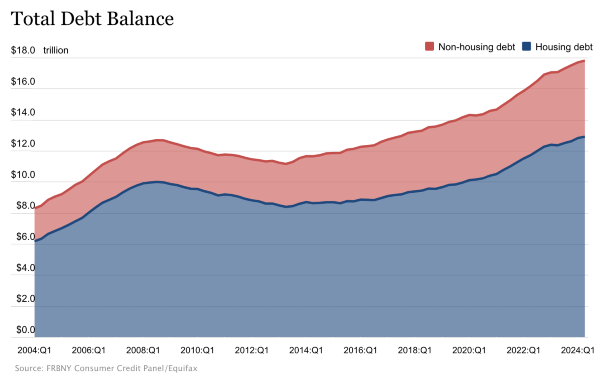

Many Americans have followed suit. Today, credit card debt sits at record highs.

Credit is used to pay for things we need or want today, with money we will (hopefully) earn tomorrow.

The borrower agrees to repay the original principle, with interest, over time.

When used responsibly and to increase productivity, debt can be a useful tool.

But sometimes, folks run into problems.

They overspend. Their income does not keep up or turns off completely.

They buy too much on credit for things they really didn't need or couldn't afford.

This wreaks havoc.

It compounds on itself.

If bad enough, it can lead to bankruptcy.

Like any business or household, the Government should have enough money coming in to cover expenses.

It generates the majority of its income through taxes.

But over the last 54 years, the U.S. has spent more than it has earned in all but 4 years.

Way more.

And it has continued to compound on itself, devaluing our currency along the way.

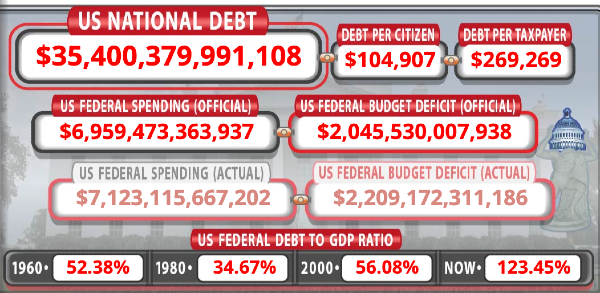

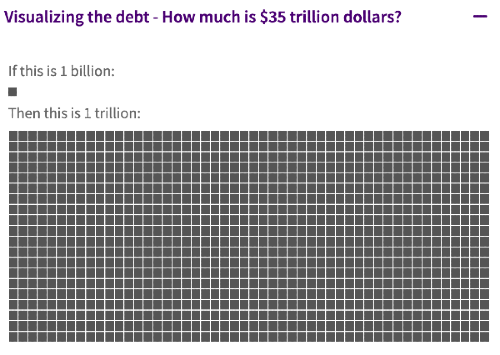

Today, total U.S. Debt now stands at over $35 Trillion dollars.

The U.S. is essentially taking out new credit cards to make interest payments on the one's they've maxed out.

With a growing pile of interest expense, there's a lot less flexibility in the budget to be found.

So the Government borrows more and more each year to make up the difference.

There are no signs of this slowing down. In fact, it is speeding up- with the national debt doubling over the last 15 years.

Interest payments on the existing debt alone have become a significant line item within the US annual budget.

The CBO (Congressional Budget Office) is a federal agency that analyzes budget and economic issues.

They have projected that interest payments on our debt will surpass our entire defense budget by 2033.

By 2051, interest costs will become the largest category- exceeding the amount spent on Social Security.

As we have covered previously - to finance this spending the government issues debt securities, and the Federal Reserve prints more money to buy them.

While this injects needed liquidity into the system, the money supply is further diluted- causing more inflation.

In attempts to mitigate inflation, the Fed waives their wand and raises interest rates (the cost of borrowing money).

Rising interest rates mean higher interest payments.

Which mean even less budget flexibility, and more borrowing.

The Fed will likely continue doing everything they can to keep interest rates low.

More money will be air dropped into the economy, and inflation will run hot.

Tensions will keep rising.

Trust will continue to erode.

We can't pinpoint an exact 'come-to-jesus' moment.

No one knows how this will ultimately play out.

But the signs point to hard times ahead.

We are borrowing from ourselves- what's the big deal?

We've borrowed from our future, from our children.

The bill will come due.

By now, you may be thinking- great, but how do I protect myself and my family?

It starts with a real financial education.

And no, not just the usual lessons on budgeting, saving, and investing.

Those matter, but understanding money itself is crucial.

Learn how to safeguard your wealth from a system designed to siphon it away.

Explore ways to store, grow, and transfer value over time.

Build a foundation that will provide durability and resilience, no matter the circumstances.

In a world where security feels like an illusion, the best investment is in yourself.

Member discussion