Money: An Illusion We're All Addicted To?

"'Cause it's a bittersweet symphony, that's life

Tryna make ends meet, you're a slave to money then you die"

-The Verve | Bittersweet Symphony

Money.

A system we all consent to- without much choice or reflection.

But what is money, really?

At first glance, it seems like a simple question.

But beneath the surface, it's anything but.

If, as The Verve suggests, we are slaves to money, then we must understand it.

Perhaps, though, it's not money that enslaves us—but those who control it.

Money is the medium we use to exchange value- whether that be a product, good or service.

With money, you are able to store value over time.

The value is your time and energy.

You do things or make things for others, and you get paid.

But we didn't always have money.

Barter and The Origins of Money

Before money existed, we used a barter system.

Goats for a plow.

A cow for shoes.

A bag of grain for some tools.

While useful, bartering was cumbersome and inefficient.

To transact, both parties needed what each other were selling.

Life was a constant negotiation with a used car salesman.

Gradually, bartering was phased out in favor of money.

Items such as stones, beads, and shells became forms of currency.

These items shared several properties that made them viable:

- They were divisible.

- They were fungible (interchangeable and replaceable).

- They were portable.

As much of an improvement as this was over bartering, it wasn't scalable.

Scarcity was limited by geographic location.

If you found yourself in Africa or Asia and were packing cowrie shells, you were in business.

Elsewhere...not so much.

Portability was questionable.

The Yapese people used giant stone money known as rai.

At one point, a large rai stone was being transported by a canoe when it fell off and sank to the bottom of the ocean.

Fortunately, the owner was still able to count it as part of his wealth- as everyone on the island agreed it was 'there'. [1]

But yeah, not great.

Trade was expanding and the world was becoming more complex.

This reality demanded a more universal form of currency.

Enter the metals.

Monetary Metals

Gold, silver, and copper addressed many of the problems that earlier forms of currency ran into.

Metals were durable, making them ideal for long-term value storage.

They were minted into standardized coins, which increased trust and uniformity in transactions.

Their scarcity and aesthetic appeal also contributed to their widespread acceptance.

However, transporting large amounts of metal was risky and impractical.

And so, the evolution of money continued.

Paper Money and Fractional Reserve Banking

China was the first civilization to introduce paper money–essentially IOU's–backed by physical stores of gold and silver. Europe soon followed.

This laid the groundwork for fractional reserve banking.

Banks realized that depositors were unlikely to withdraw all their gold and silver at the same time.

As a result, they started issuing more paper money than they had in reserves, lending out the excess to earn interest while assuming they’d still be able to cover withdrawals if needed.

Modern credit was born, effectively creating money that didn’t physically exist.

This system helped expand economies, as long as confidence in the banks remained.

But during times of financial panic, confidence faltered, leading to bank runs.

The Gold Standard - Hard Money

In the United States, the Coinage act of 1792 established the US Dollar as its own version of paper currency.

It was pegged to specific amounts of silver and gold.

By the late 19th century, most of the world's major economies had followed suit.

The gold standard ushered in a period of growth and price stability.

However, governments felt constrained during economic downturns and international incidents.

Wars, in particular, were costly.

World War I saw the US along with other nations suspend the gold standard, printing money to finance military operations.

The war was won, but in its wake were inflation and financial chaos.

In 1929, the combination of war debt, inflation, unemployment, and stock market speculation triggered the great depression.

Many countries abandoned the gold standard to address the crisis.

During this period, FDR famously issued executive order 6102.

This required Americans to hand over their gold in exchange for US paper money.

Bretton Woods

After World War II, a new international monetary system was established.

Currencies were pegged to the U.S. dollar, which in turn was tied to gold.

The U.S. dollar became the world's reserve currency.

However, international conflict one again caused the U.S. Government to blink.

The Vietnam War had the US money printers working overtime- creating more paper currency then there were gold reserves to back it.

FIAT & the Rise of Digital Currency

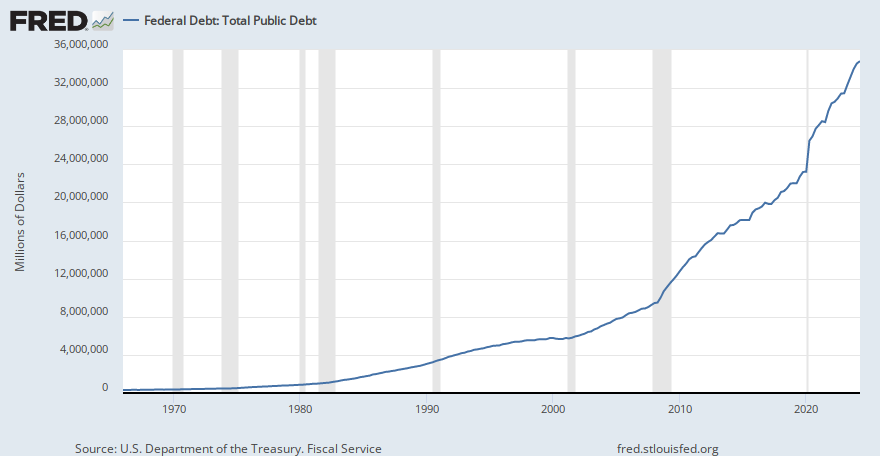

In 1971, the United States officially bailed on the gold standard altogether.

This event, known as the Nixon Shock, severed the US Dollar's peg to gold.

From that moment forward, we have been operating under the fiat currency system.

Fiat, derived from Latin, means "let it be done".

With the dollar no longer tied to a physical commodity, its value was now maintained through government decree, power and control.

As technology advanced, money shifted from physical forms to digital transactions, reshaping the financial system.

Blockchain technology and Bitcoin further disrupted the traditional models of currency and value.

By enabling decentralized, transparent, and trustless transactions against a fixed supply, Bitcoin has introduced a new system that challenges the reliance on physical commodities and centralized institutions.

In the early 1900's, the United States established the Federal Reserve.

A "lender of last resort"- the Feds mandate includes stabilizing the financial system and managing the money supply.

When the U.S. removed the constraints inherent to a hard money system, the Federal Reserve gained the ability to influence the economy at will.

While this flexibility offers convenience, it also brings significant risks and moral hazard.

Sometimes, it's too convenient.

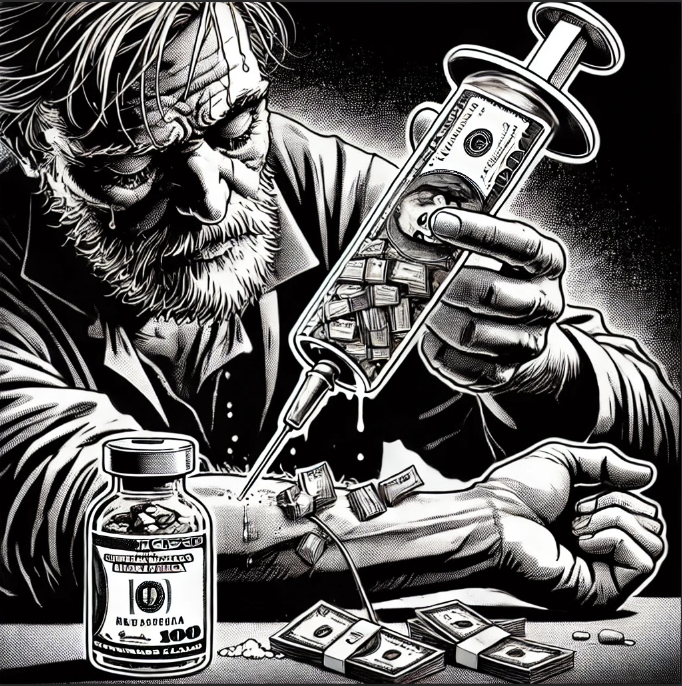

As we have seen, when shit hits the fan, the Fed injects massive amounts of money into the system, a process known as quantitative easing.

The 2008 financial crisis is a prime example.

But like a drug, this creates only a temporary fix.

Over time, higher doses are required to achieve the same effect.

Eventually, the system becomes dependent, requiring a constant influx just to stay functional.

And as with any drug, there can be side effects.

These may include inflation, market bubbles, growing inequality, increased national debt, and long-term economic instability.

The U.S Dollar remains king- for now.

But for how much longer?

Most people perceive money as something objective- but it's simply a belief system.

An agreement to assign value to something.

Its worth derives solely from the collective trust we place in it.

So what's in your wallet?

How are you storing your time and energy?

What do you believe in?

1.(Goldstein, Jacob; Kestenbaum, David. "The Island of Stone Money". NPR.org. NPR)

Member discussion