Straying From the Herd- The 1930s Blueprint for Trading Success

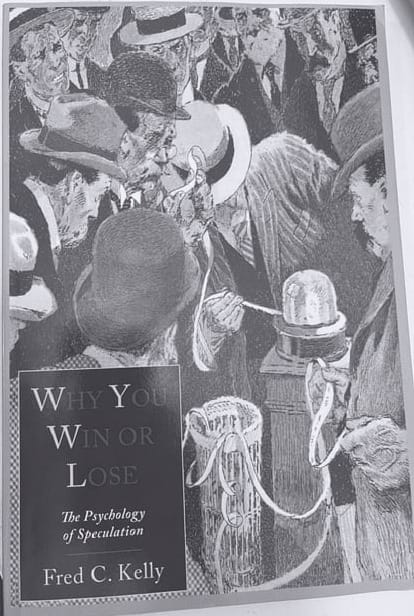

Everything you need to know to succeed in speculating is jammed into a 75-page book, written in 1930, that you can buy for $6.

Fred Kelly wrote "Why You Win or Lose - The Psychology of Speculation" to explain why most people fail at trading.

Speculating, or trading, differs from traditional investing in its approach and goals.

Investing aims to grow wealth gradually over a long period of time.

In contrast, speculating seeks to profit from short-term price movements in financial markets, often involving higher risk.

It is often viewed as a zero-sum game- when one trader wins, another loses or earns less.

Over the long haul, assets tend to rise due to productivity gains, innovation, and inflation.

It is the volatility along the way of which speculators attempt to capitalize on for profit.

Most, however, are unsuccessful.

In fact, statistics suggest that 80%-90% of traders lose money.

It's easy to assume that those who succeed have access to some secret formula.

This couldn't be further from the truth.

Here are five reasons why speculators fail and ultimately part ways with their money, according to Kelly:

Ego

Kelly equates ego with vanity.

In both markets and life, people often overestimate their skill or knowledge.

They crave being right more than making money.

Rather than trading from a system and thinking in probabilities- they enter into trades based on what they believe will happen.

When the trade goes against them, instead of cutting losses, they double down.

Their ego refuses to admit the trade was simply wrong.

Greed

Speculators who let greed take over wash out quickly.

They may have a well thought out strategy but abandon it when they need it most.

Overtrading and taking excessive risks become the norm.

When a trade is going their way, rather than taking profits, they want more.

Inevitably, the market reverses, often dropping below the price at which they originally entered the trade.

Another painful lesson- and another loss.

Credulity

People want to believe that someone has a crystal ball.

Especially if they are paying for it.

In the information age, there is more hot tips, market newsletters, and rumors than ever.

Traders often borrow conviction instead of thinking for themselves.

They place blind faith- and their stack of chips- into someone else's hands.

But there is no crystal ball.

Those who claim otherwise are likely profiting from selling this hope, not from trading.

Rational Thinking

Kelly explains that logic often fails in markets.

As a current example, during the Covid-19 pandemic, many were baffled when markets quickly rebounded to new highs.

Markets are a discounting mechanism, pricing in both known and unknown future events.

Buy the rumor, sell the news.

Markets often defy conventional logic because they're driven by emotions, sentiment, and positioning.

Decisions that seem reasonable based on facts frequently lead to unexpected outcomes.

HERD Mentality

Following the herd in life can keep you alive.

In markets, it can get you killed.

Conforming to societal norms can help us fit in.

We seek safety in numbers, often unconsciously mimicking those around us.

In trading, this manifests as the fear of missing out, panic buying, and panic selling.

Whether it’s ARK, Bitcoin, Gold, or GameStop, many traders end up buying at the top and selling at the bottom.

To make money in trading, one must learn adopt a contrarian approach.

Yet being contrarian alone is not a golden ticket.

Flexing your contrarian muscles at the wrong time can be just as destructive as following the herd.

In trading, success hinges on having a well-defined system and an edge.

The system is a set of rules that tell you when to get in, when to get out, and when to take profit.

The edge is having a disciplined mindset.

Trading is a lifelong practice.

Every setback is an opportunity to learn and grow.

Perseverance and adaptability are your greatest assets.

Member discussion